Life insurance benefits

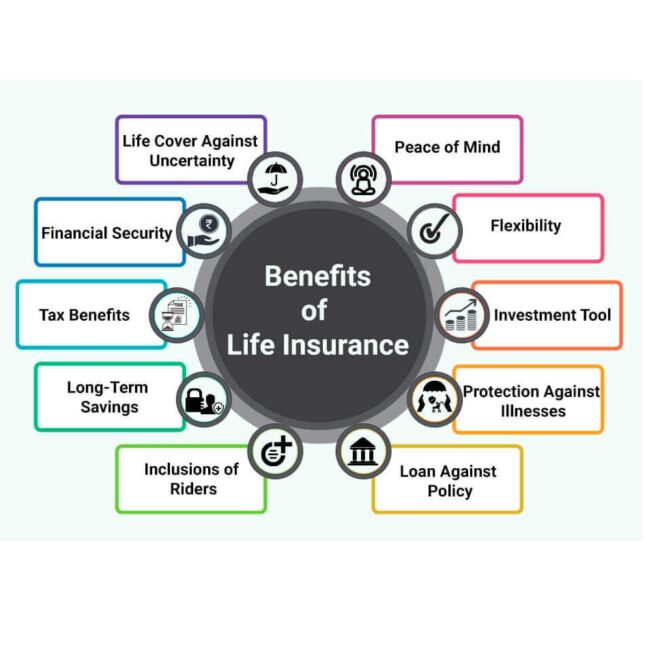

Life insurance offers several benefits that can provide financial security and peace of mind to policyholders and their loved ones. Here are some of the key benefits of life insurance:

- Financial Protection: One of the primary benefits of life insurance is to provide financial protection to the insured’s beneficiaries in the event of their death. The death benefit paid out by the insurance company can help replace lost income, cover living expenses, pay off debts, such as mortgages or loans, and maintain the family’s standard of living.

- Estate Planning: Life insurance can play a crucial role in estate planning by providing liquidity to cover estate taxes, settlement costs, and other expenses that may arise upon the insured’s death. This can help preserve the value of the estate and ensure a smooth transfer of assets to heirs and beneficiaries.

- Debt Repayment: Life insurance proceeds can be used to pay off outstanding debts, such as mortgages, car loans, credit card balances, and personal loans. This can prevent financial burden and hardship for surviving family members and ensure that they can maintain ownership of important assets, such as a family home.

- Income Replacement: For individuals who are the primary breadwinners or contribute significantly to their family’s income, life insurance can provide a crucial safety net by replacing lost income in the event of their premature death. The death benefit can help ensure that surviving family members can continue to meet their financial obligations and achieve their long-term financial goals.

- Education Funding: Life insurance can be used to fund future education expenses for children or grandchildren. The death benefit can help cover the cost of tuition, books, and other educational expenses, ensuring that beneficiaries have access to quality education regardless of the insured’s absence.

- Business Continuity: Life insurance can play a vital role in business succession planning by providing funds to buy out a deceased partner’s share of the business, repay business debts, or cover operating expenses during a transition period. This can help ensure the continuity and stability of the business in the event of the owner’s death.

- Tax Advantages: In many cases, life insurance proceeds are not subject to income tax when paid out to beneficiaries. Additionally, the cash value accumulation in certain types of permanent life insurance policies may grow tax-deferred, providing potential tax advantages for policyholders.

- Peace of Mind: Knowing that loved ones will be financially protected and provided for in the event of one’s death can offer peace of mind and alleviate concerns about the future. Life insurance can provide reassurance that financial responsibilities will be met, allowing individuals to focus on enjoying life without worrying about the unexpected.

Overall, life insurance offers a range of benefits that can help individuals and families achieve their financial goals, protect their assets, and secure their loved ones’ future.

Category: Life Insurance, Retirement Plan