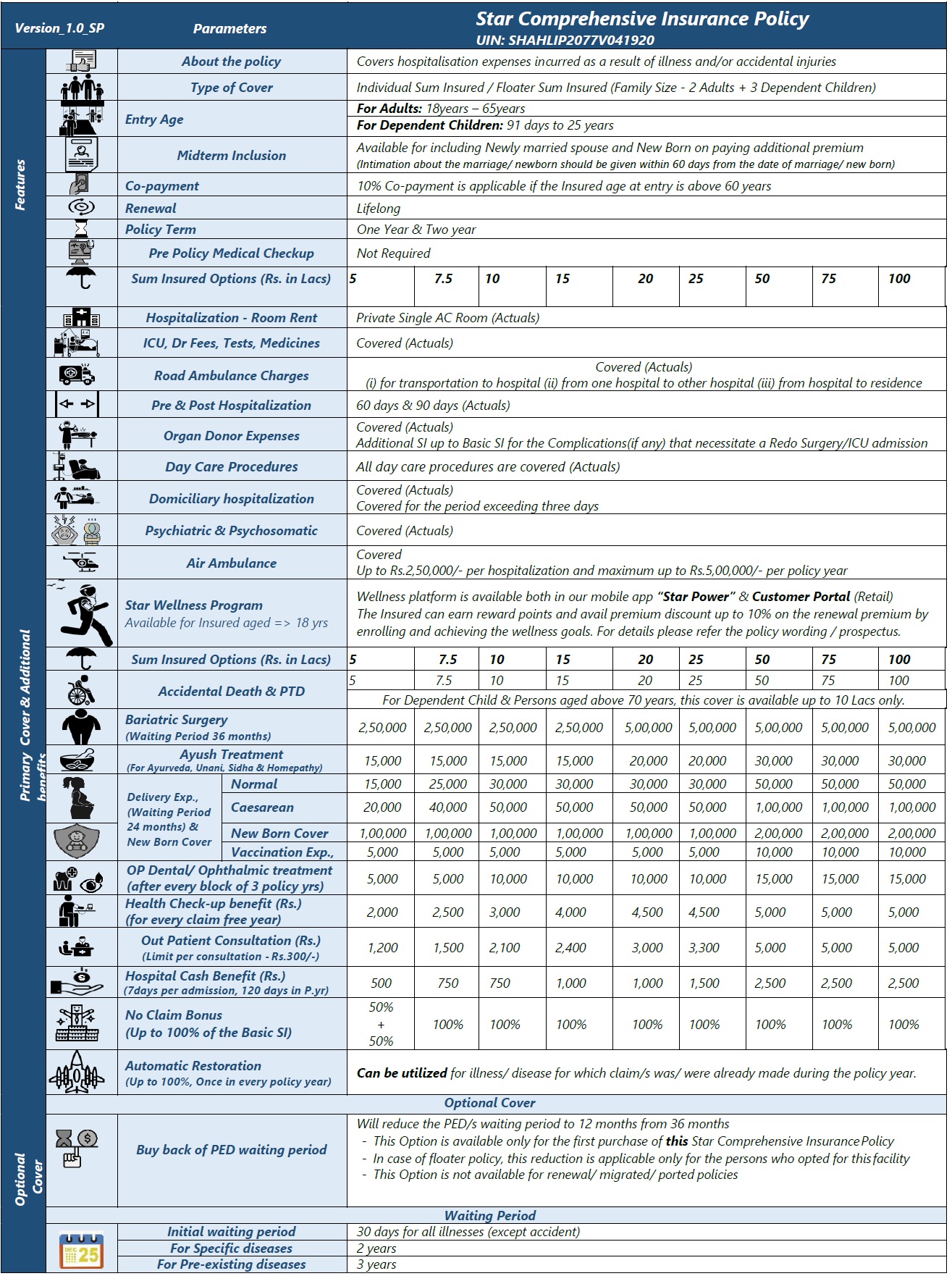

Star Comprehensive Insurance Policy

Version_1.0_SP Parameters Star Comprehensive Insurance Policy UIN: SHAHLIP2077V041920 Features About the policy

Covers hospitalisation expenses incurred as a result of illness and/or accidental injuries Type of Cover

Individual Sum Insured / Floater Sum Insured (Family Size – 2 Adults + 3 Dependent Children) Entry Age

For Adults: 18years – 65years

For Dependent Children: 91 days to 25 years Midterm Inclusion

Available for including Newly married spouse and New Born on paying additional premium

(Intimation about the marriage/ newborn should be given within 60 days from the date of marriage/ new born) Co-payment

10% Co-payment is applicable if the Insured age at entry is above 60 years Renewal

Lifelong Policy Term

One Year & Two year Pre Policy Medical Checkup

Not Required Sum Insured Options (Rs. in Lacs)

5

7.5

10

15

20

25

50

75

100 Primary Cover & Additional benefits Hospitalization – Room Rent

Private Single AC Room (Actuals) ICU, Dr Fees, Tests, Medicines

Covered (Actuals) Road Ambulance Charges

Covered (Actuals)

(i) for transportation to hospital (ii) from one hospital to other hospital (iii) from hospital to residence Pre & Post Hospitalization

60 days & 90 days (Actuals) Organ Donor Expenses

Covered (Actuals)

Additional SI up to Basic SI for the Complications(if any) that necessitate a Redo Surgery/ICU admission Day Care Procedures

All day care procedures are covered (Actuals) Domiciliary hospitalization

Covered (Actuals)

Covered for the period exceeding three days Psychiatric & Psychosomatic

Covered (Actuals) Air Ambulance

Covered

Up to Rs.2,50,000/- per hospitalization and maximum up to Rs.5,00,000/- per policy year Star Wellness Program Available for Insured aged => 18 yrs

Wellness platform is available both in our mobile app “Star Power” & Customer Portal (Retail)

The Insured can earn reward points and avail premium discount up to 10% on the renewal premium by enrolling and achieving the wellness goals. For details please refer the policy wording / prospectus. Sum Insured Options (Rs. in Lacs)

5

7.5

10

15

20

25

50

75

100 Accidental Death & PTD

5

7.5

10

15

20

25

50

75

100

For Dependent Child & Persons aged above 70 years, this cover is available up to 10 Lacs only. Bariatric Surgery (Waiting Period 36 months)

2,50,000

2,50,000

2,50,000

2,50,000

5,00,000

5,00,000

5,00,000

5,00,000

5,00,000 Ayush Treatment (For Ayurveda, Unani, Sidha & Homepathy)

15,000

15,000

15,000

15,000

20,000

20,000

30,000

30,000

30,000 Delivery Exp., (Waiting Period 24 months) & New Born Cover Normal

15,000

25,000

30,000

30,000

30,000

30,000

50,000

50,000

50,000 Caesarean

20,000

40,000

50,000

50,000

50,000

50,000

1,00,000

1,00,000

1,00,000 New Born Cover

1,00,000

1,00,000

1,00,000

1,00,000

1,00,000

1,00,000

2,00,000

2,00,000

2,00,000 Vaccination Exp.,

5,000

5,000

5,000

5,000

5,000

5,000

10,000

10,000

10,000 OP Dental/ Ophthalmic treatment (after every block of 3 policy yrs)

5,000

5,000

10,000

10,000

10,000

10,000

15,000

15,000

15,000 Health Check-up benefit (Rs.) (for every claim free year)

2,000

2,500

3,000

4,000

4,500

4,500

5,000

5,000

5,000 Out Patient Consultation (Rs.) (Limit per consultation – Rs.300/-)

1,200

1,500

2,100

2,400

3,000

3,300

5,000

5,000

5,000 Hospital Cash Benefit (Rs.) (7days per admission, 120 days in P.yr)

500

750

750

1,000

1,000

1,500

2,500

2,500

2,500 No Claim Bonus (Up to 100% of the Basic SI)

50%

+ 50%

100%

100%

100%

100%

100%

100%

100%

100% Automatic Restoration (Up to 100%, Once in every policy year)

Can be utilized for illness/ disease for which claim/s was/ were already made during the policy year. Optional Cover Optional Cover Buy back of PED waiting period

Will reduce the PED/s waiting period to 12 months from 36 months

– This Option is available only for the first purchase of this Star Comprehensive Insurance Policy

– In case of floater policy, this reduction is applicable only for the persons who opted for this facility

– This Option is not available for renewal/ migrated/ ported policies Waiting Period Initial waiting period

30 days for all illnesses (except accident) For Specific diseases

2 years For Pre-existing diseases

3 years

Category: Health Insurance